best low income mortgage lenders and how to choose wisely

What makes a lender a strong fit

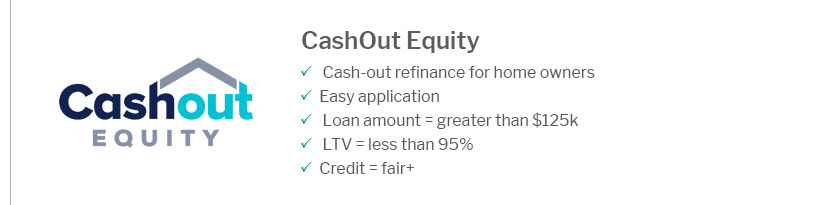

The best low income mortgage lenders pair fair pricing with flexible underwriting, layering programs such as FHA, USDA, or VA with state housing finance agency aid. They offer transparent fees, responsive guidance, and patient preapproval support so you can shop with confidence.

Benefits and practical use cases

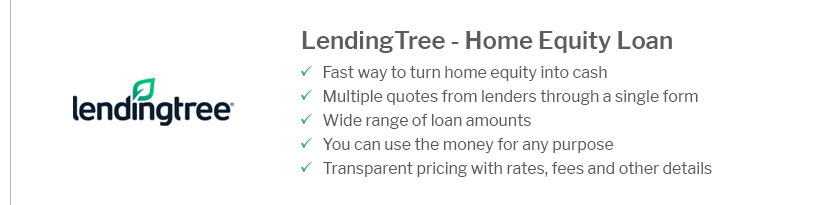

Good providers help you stack down payment assistance, qualify with alternative credit data, and access homebuyer education that strengthens your file. Many use manual underwriting for thin credit histories and provide grants or lender credits to reduce cash-to-close.

- Portfolio and community banks: localized insight, income-based pricing reviews.

- Credit unions: member-first service, lower fees, flexible debt ratios.

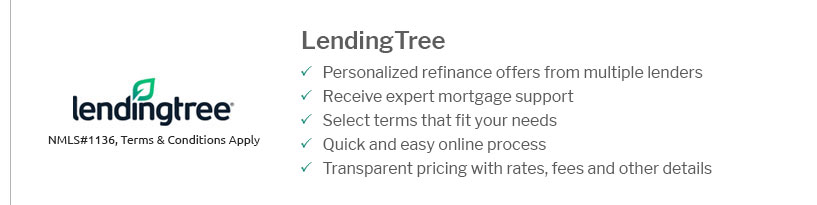

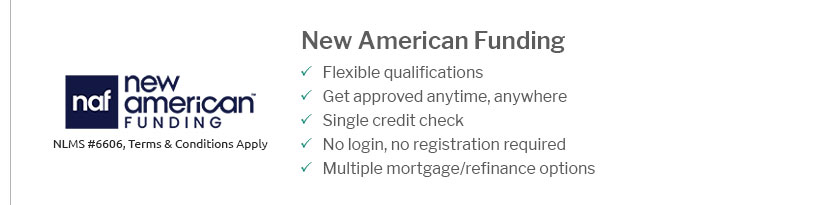

- Online lenders: speedy quotes and rate locks for tight timelines.

- HFAs and nonprofit partners: forgivable seconds and counseling.

- Specialist teams for gig workers or multi-source income.

Compare APR, discount points, and total cash at closing, not just rate. Request a Loan Estimate from three lenders, ask about layered assistance, and choose the offer that balances monthly payment, reserves, and long-term stability.