|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring the Best Low-Income Mortgage LendersIn today's economic landscape, homeownership remains a cherished dream for many, yet the path to acquiring a home can be especially daunting for low-income individuals. Thankfully, a variety of lenders have recognized this challenge and offer mortgage solutions tailored to accommodate those with limited financial resources. This article delves into some of the best low-income mortgage lenders, providing insights that may assist potential homeowners in making informed decisions. Whether you're a first-time buyer or someone looking to refinance under more favorable terms, understanding the nuances of these lenders can be crucial. Understanding Low-Income Mortgages Before we delve into specific lenders, it's vital to understand what makes a mortgage suitable for low-income borrowers. Typically, these mortgages are characterized by lower down payment requirements, competitive interest rates, and flexible credit criteria. Government-backed loans such as FHA, USDA, and VA loans are often accessible, offering potential relief through reduced financial barriers. However, not all lenders are created equal, and their terms, customer service, and availability can vary significantly.

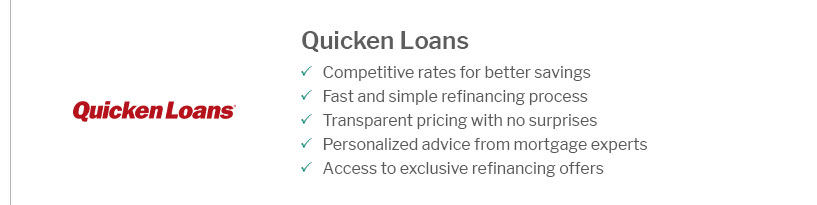

Quicken Loans, now known as Rocket Mortgage, stands out for its cutting-edge approach to lending. The company's digital platform simplifies the mortgage process, making it accessible even to those who may feel overwhelmed by traditional methods. Its FHA loan options are particularly appealing for low-income borrowers due to low down payment requirements. However, some may find the reliance on digital communication less personal compared to face-to-face interactions.

Wells Fargo offers a range of mortgage products designed for low-income individuals, including FHA and VA loans. Known for its extensive branch network, it provides the convenience of in-person consultations, which can be reassuring for those who prefer direct human interaction. While Wells Fargo has faced challenges in the past, its long-standing reputation and efforts to rebuild trust make it a notable contender in this space.

Bank of America offers the Affordable Loan Solution® mortgage, specifically tailored for low-to-moderate income borrowers. This product requires a low down payment and does not necessitate private mortgage insurance (PMI), which can significantly reduce monthly costs. The bank's commitment to financial education and assistance programs further enhances its appeal, although its large size can sometimes lead to a less personalized experience.

USDA loans are a fantastic option for those considering rural living. These loans often come with zero down payment requirements and competitive interest rates. They are specifically designed for low-income individuals, making them an attractive choice for eligible borrowers. However, the eligibility criteria can be strict, focusing on property location and income limits.

For those who prefer a more community-focused approach, local credit unions can offer personalized service and often provide more flexibility in their lending criteria. Credit unions frequently offer lower fees and better interest rates than traditional banks, though they may have a more limited range of products. Building a relationship with a credit union can yield significant benefits, particularly in terms of customer service and community support. Final Thoughts In conclusion, selecting the best low-income mortgage lender involves careful consideration of various factors, including the type of loan, terms offered, customer service, and personal preferences regarding digital versus in-person interactions. Each lender brings unique strengths to the table, and potential borrowers should weigh these alongside their own financial circumstances and long-term homeownership goals. As the journey to homeownership continues to evolve, these lenders play a critical role in making the dream accessible to all, ensuring that financial constraints do not stand as insurmountable barriers to achieving a place to call home. https://www.reddit.com/r/FirstTimeHomeBuyer/comments/16y9qe1/lenders_who_approve_very_low_income/

Wondering if I have a chance at a mortgage pre-approval loan. I'm also low income. I was making 36k all year until my hours got cut drastically ... https://www.cnbc.com/select/mortgage-lenders-for-a-small-down-payment/

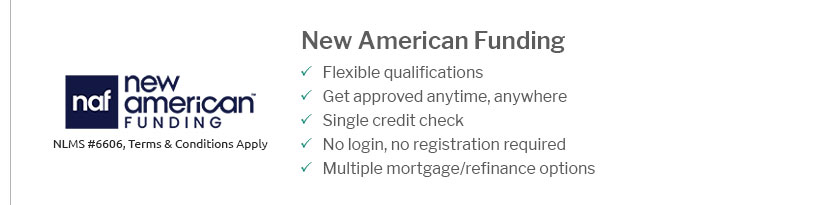

Best online lender: Rocket Mortgage - Best for no down payment: Guild Mortgage - Best for affordability: New American Funding - Best for low-income ... https://www.forbes.com/advisor/mortgages/best-mortgage-lenders-with-low-down-payment/

Best Mortgage Lenders For Low And No Down Payments Of 2025 - Bank of America - BMO - Chase - Citi - Connexus Credit Union - Navy Federal Credit Union ...

|

|---|